Research Highlights the Role of Employment in Divorce

By Scott Dawson, MS, CFP®

Money disagreements have been at or near the top of the list for reasons why marriages fail. While divorce rates have been dropping recently, 40 – 50% of marriages still end in divorce. There are many reasons why couples can’t make the relationship work, but money has been one of the main culprits.

I recently read an interesting article discussing a Harvard sociology professor and researcher, Alexandra Killewald, who found that the biggest factor leading to divorce is the husband’s job status. The study involved data on 6,300 married couples going as far back as the 1970s. The study showed that husbands who had been out of work for a long time had a higher chance of getting divorced than husbands who had stable employment. Men without jobs increased their odds of divorce by roughly 30%. The study found that the husband’s involuntary unemployment may negatively affect marriages more strongly than voluntary unemployment. The study results also indicate that women who were voluntarily or involuntarily unemployed didn’t have a significant risk for divorce.

One could conclude that the historical norm of the husband being the breadwinner still exists even though more women are working instead of staying at home with the kids. A stay-at-home husband’s risk of divorce may not be greater because it was a voluntary decision made by the family. The financial and emotional stresses that are caused by a husband’s inability to find full-time work and provide for the family seems to create more marital problems.

The study’s findings reinforced the importance of education, knowledge, and skills. Being employable is good for a couple’s financial well-being and marriage. Continuing to improve your skills and knowledge is a good practice in today’s ever changing economy and also in keeping a happy home life.

Equifax Breach: Were you Affected?

By Scott Dawson, MS, CFP®

As you have probably heard, Equifax had a cybersecurity attack that potentially impacted 143 million Americans. The hackers accessed Equifax’s database from mid-May until July 2017 and they captured names, birth dates, addresses, social security numbers, and driver’s license numbers. In addition, 209,000 Americans may have had their credit card numbers accessed.

What steps do you need to take to see if you were affected? The first step is to check if you were one of the 143 million affected by the breach. You can visit Equifax’s website www.equifaxsecurity2017.com to determine if your information has been compromised. Once on the website, click Potential Impact and you will be prompted to enter your last name, and last 6 digits of your social security number, and then confirm you are not a robot. You will be told instantly whether you were impacted by the breach.

Because of the data breach, Equifax is offering one year free of credit monitoring to all Americans, which you can enroll for on the above mentioned website. Credit monitoring doesn’t prevent hackers from using your data, but helps you to monitor suspicious activity.

Whether you were impacted or not by the breach, it’s always a good practice to check your credit reports annually and look for unfamiliar or suspicious activity. Individuals are allowed to receive one free credit report every twelve months from each of the three credit reporting agencies: Equifax, TransUnion, and Experian. You can request your credit reports from www.annualcreditreport.com. In addition, always review your bank and credit card statements. Comb through each statement to ensure that you did make each purchase or initiated each transaction. Identity thieves sometimes start small and then go big.

If Equifax says your personal information has been compromised, you have a couple options: place a credit freeze or fraud alert on your credit files.

A credit freeze restricts access to your credit report, which means you or no one else can open new credit using your personal information. If you needed to make a purchase requiring a new application for credit, like a car loan or home refinance, you will be required to unfreeze your credit file. To initiate a freeze, contact all three credit reporting agencies by phone or internet. The cost to freeze and unfreeze your credit file varies by state. The cost usually is no more than $10 for each credit reporting agency, though Equifax is now waiving their fee.

Another option is a fraud alert. The fraud alert informs creditors that your identity may have been compromised and creditors will need to verify the identity of the individual trying to establish credit. To initiate a fraud alert, you can contact one of the three credit reporting agencies and the credit agency will alert the other two. Fraud alerts are available for 90 days or 7 years. A fraud alert for 7 years is only available to individuals who have been victims of identity theft and must provide documentation to the credit agencies. Otherwise, a fraud alert is only available for 90 days, but you can renew after it expires. There is no cost to place a fraud alert on your credit files.

To obtain more detailed information, visit the Equifax and Federal Trade Commission’s websites.

Please contact us if you have any questions.

Talking Money with your Kids

By Scott Dawson, MS, CFP®

When I became a parent for the first time, I received a lot of advice from other parents. One piece of advice was to read to your baby. It didn’t matter what you read, I was told, just read something. Of course, I wanted to do the best for my daughter so I read to her every day. Being a working parent means my time is limited however, so instead of reading Dr. Seuss or children’s books, I read the Journal of Financial Planning, Money Magazine, Kiplinger’s, and financial articles that I either needed to read or wanted to read anyway. My hope was to catch up on my own reading, but in the process I might also plant the seeds that would eventually create a financially savvy daughter.

Fast forward five years and my oldest daughter just finished her first year of elementary school. It was a fantastic experience for her and us. School created so many memories and one in particular stands out for me.

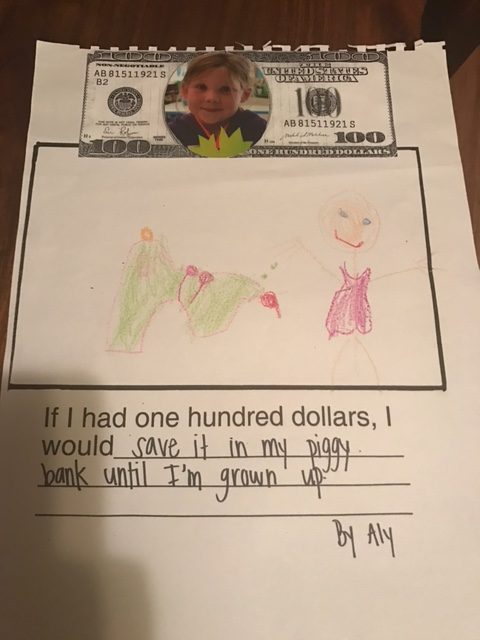

The teacher asked all the students in the class, “if I had $100, I would _____.” The teacher recorded all the responses and created a scrapbook with a picture of each student, the question, and the student’s answer. The scrapbook was sent home for each family to see. As my spouse and I were flipping through the scrapbook, we were reading all the cute responses from the students. Many responded as expected, using their $100 windfall to buy candy, dolls, or toys. Our daughter’s response was near the back of the scrapbook. As we got to her page, we saw it: “If I had $100, I would save it in my piggy bank until I’m grown up.”

Is your financial planner a CFP® professional?

By Scott Dawson, MS, CFP®

Did you know anyone can use the title financial planner and not all financial planners are certified? Only financial planners who have the CERTIFIED FINANCIAL PLANNER ™ or CFP® designation are actually certified. The CFP® certification is the gold standard in the industry and only planners who have fulfilled the certification requirements of the CFP Board can claim to be a CFP® professional.

To be a CFP® professional, a planner must abide and complete the four requirements known as the 4 E’s, which are Education, Examination, Experience, and Ethics.

Education

CFP® professionals must complete financial planning coursework through a college or university’s financial planning program as a prerequisite to taking the CFP® exam. The required coursework includes financial planning, insurance, retirement planning, employee benefits, investments, estate planning, and income taxes.

Examination

After completing all the financial planning coursework, the next step is taking the CFP® exam. The CFP® exam is a rigorous, comprehensive 6 hour exam covering the financial planning coursework with case studies and questions to ensure that the planner has the knowledge and is highly qualified to help a client with their finances.

Experience

In additional to completing the education and exam components, CFP® professionals must have at least three years of financial planning-related experience. This ensures the planner has real life practical client experience with the theoretical knowledge from their coursework to help clients develop a financial plan based on their individual needs.

Ethics

CFP® professionals are also held to the Standards of Professional Conduct as outlined by the CFP Board. Planners are obliged to uphold the principles of integrity, objectivity, competence, fairness, confidentially, professionalism and diligence as outlined in CFP’s Code of Ethics. The Rules of Conduct require CFP® professionals to act in the best interest of their clients. The CFP Board has the right to revoke the use of the CFP® certification for the violation of these standards.

To maintain the CFP® certification, a planner must complete 30 hours of continuing education every two years, which includes 2 hours of ethics. This is critical to keep up with the ongoing changes in the industry.

When looking for a financial planner or advisor, I always recommend confirming that your planner has the CFP® certification.

More Mangoes, More Money

By Scott Dawson, MS, CFP®

Mangoes are relatively new in my life. My mother never bought them. My friends never ate them and so it wasn’t until I was first exposed to mangoes on a surf trip with my brother to Ecuador in 2008. On that trip, I had my first taste and ate one every day and also ordered fresh mango drinks, which consisted of pureed mango and water, with meals. My brother commented, at one point near the end of the trip, “another mango!” Ever since that trip, my brother has consistently given me a mango for my birthday or Christmas.

As I eat my lunch today, which includes a mango, I was thinking about how the spending decisions we make every day affect our finances. As a consumer, I am very aware of what I purchase. I do my best to purchase things that I value, but am very cost conscious as well. I was raised to save a portion of what I earned and spend no more than needed.

Besides valuing mangoes, I also value eating well with cost in mind. For example, I bring my lunch to work almost every day. A typical lunch consists of a peanut butter sandwich on wheat bread, fruit, and tap water. I love my lunches. They are healthy, tasty, and low cost. The alternative would be to eat out for lunch every day. I could pick up a burrito, sushi, or Thai, but it will definitely cost me a lot more than my typical lunch. My typical lunch probably costs $2 and takeout would cost me anywhere from $7-10. The additional savings does add up over the year. A $5-8/day lunch savings, based on 240 working days, amounts to $1,200-1,900/year. Would eating lunch out on a regularly basis bring me enough joy to justify the extra $1,200-1,900 difference. To some, the answer is yes, but to me it doesn’t. I would rather spend the extra savings on a vacation, which is an experience rather a material item, for example. Studies have shown that experiences bring us much more happiness than material things. I have found this to be true for me.

This is one example of how I think and spend on things I care about without feeling like I’m depriving myself or sacrificing my pleasure. I really don’t feel like I’m missing out by bringing my lunch. Everyone is unique and believe there are opportunities to examine what we truly care about and take action to reduce spending on things that we might not value and reallocate those savings to things that you really do care about and value. For me I bring my lunch to work, for you, it is ________?