Talking Money with your Kids

By Scott Dawson, MS, CFP®

When I became a parent for the first time, I received a lot of advice from other parents. One piece of advice was to read to your baby. It didn’t matter what you read, I was told, just read something. Of course, I wanted to do the best for my daughter so I read to her every day. Being a working parent means my time is limited however, so instead of reading Dr. Seuss or children’s books, I read the Journal of Financial Planning, Money Magazine, Kiplinger’s, and financial articles that I either needed to read or wanted to read anyway. My hope was to catch up on my own reading, but in the process I might also plant the seeds that would eventually create a financially savvy daughter.

Fast forward five years and my oldest daughter just finished her first year of elementary school. It was a fantastic experience for her and us. School created so many memories and one in particular stands out for me.

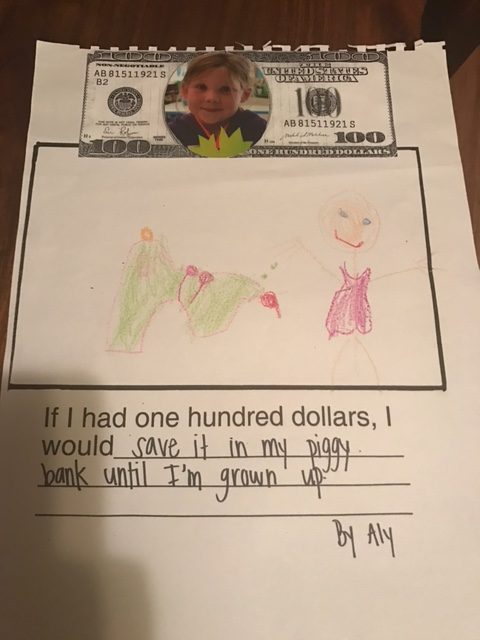

The teacher asked all the students in the class, “if I had $100, I would _____.” The teacher recorded all the responses and created a scrapbook with a picture of each student, the question, and the student’s answer. The scrapbook was sent home for each family to see. As my spouse and I were flipping through the scrapbook, we were reading all the cute responses from the students. Many responded as expected, using their $100 windfall to buy candy, dolls, or toys. Our daughter’s response was near the back of the scrapbook. As we got to her page, we saw it: “If I had $100, I would save it in my piggy bank until I’m grown up.”